Severe Weather Australia

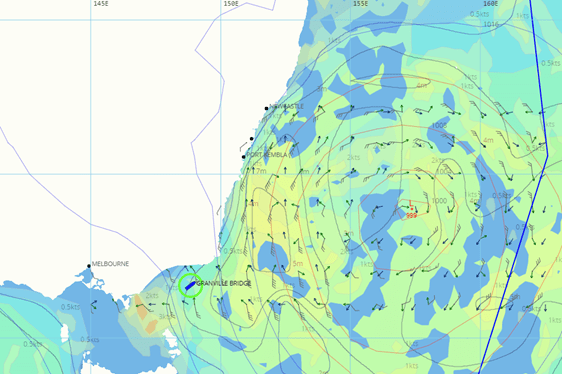

Stockwell International has been advised that carriers are not able to meet schedules due to developing rough weather off the east coast of Australia.

Due to safety concerns, carriers will be taking shelter until weather is calm and it is safe to proceed to schedule.

In turn this may cause further delays in vessels arriving to their final destinations, because of this omissions may be called.

Stockwells will update you with any further, relevant information.

For questions please contact your sales rep on [email protected] or 1300 786 468

Industrial Strike

Stockwell International has received notice and would like to advise customers of Toll truck drivers proposed industrial action for Friday the 27th August.

In an article online it states that trucked goods could see massive disruptions as a result of thousands of drivers striking in a dispute with Toll. Drivers have been in a ongoing disagreement with Toll management over job security, with the union saying almost all of the 7000 workers involved are in favour of the “last resort” strike.

The Transport Workers Union says food and fuel supplies will be interrupted this weekend by the arranged strike on Friday.

However Toll has guaranteed “goods will be transported” despite warning the action puts COVID-19 pandemic-related items, including vaccines, at risk of limbo. Said the TWU National Secretary, Michael Kaine.

Please keep in mind this may cause delays and congestion, for any questions please contact your sales rep or call 1300 786 468

Reference:7news.com.au

Ningbo Meishan Port Closure Update

Stockwell International would like to update customers with new information on the Ningbo Meishan Port Closure.

“NINGBO Meishan Island International Container Terminal (MSICT) has been closed since 11 August when a worker there tested positive for COVID-19. Shipping lines have been omitting Ningbo and congestion off Ningbo-Zhoushan and Shanghai is on the rise.

Trucking of empty and full containers into and out of MSICT has also been suspended, as has warehouse operations at Ningbo Bluedragon Longfei”.

Other terminals in Ningbo will reportedly be operating as per usual in early September.

“In an announcement, Maersk Line said a few vessels that call at MSICT have started to move to other terminals at Ningbo Port, but 2M alliance vessels mainly call Ningbo Beilun Container Terminal Phase 4. The company said the waiting time there is two days.

Shipping lines have been diverting cargo to other ports for transhipment. Some MSICT-bound cargo is diverting to Pusan, Hong Kong, Tianjin and other Ningbo terminals.

Data from Project44 showed that the number of weekly port calls to Ningbo-Zhoushan had decreased 22% from 188 containerships to 146 last week. This correlates with the volume of container cargo MSICT handles.

The data show that while ocean carriers are diverting to other terminals, blank sailings to Ningbo did not spike as they had following the Yantian Port closure in May. The Project44 data showed 15 blank sailings to Ningbo-Zhoushan on 17 August, which is in line with the average”.

For questions please contact your sales rep on [email protected] or 1300 786 468

Reference: dcn.com.au

Ocean Freight Update

Asia

Shipping Line EMC have announced that due to rollover and backlog at most major ports, Xingang won’t be accepting new bookings for vessels ETD Xingang before 15 September. Bookings will open for sailings in late September in a few weeks.

Shipping Line Maersk has sent a notice last week informing us that they have space for 20’ NOR import bookings from SEA and China origins into Brisbane, Sydney, Melbourne and any NZ port. This is for 20’ NOR only – as Stockwells has been advised there is no 40’ NOR equipment stock or it’s in an extreme shortage so we can’t guarantee it’s availability at the time of collection.

All carriers have announced a GRI of at least USD300/teu for services ex North-East Asia for the 2nd half of August (15th onwards). Hamburg Sud’s GRI announcement was for USD750/teu, which is the largest GRI announcement we have seen this year. It is expected that rates will continue to increase by USD300/teu every fortnight for the next 3 months.

Due to a COVID-19 outbreak in Jiangsu Province (Shanghai region), trucking costs have increased significantly due to lack of driver availability. We have been advised that all drivers delivering containers to Shanghai Port have to deliver a negative covid test within the last 48 hours. These measures have seen transport companies implement a ‘covid-19 test fee’ of USD240/driver for shipments from this area.

Ningbo and Shanghai Ports are currently at crisis point due to a combination of covid-outbreaks, equipment shortages across all carriers and recent typhoon activity in the area. In order to increase the safety of vessels during typhoon season, Shanghai Port Authority has announced a reduction on draft limit (cargo on a ship) by 15% for all vessels calling Shanghai Port. This is effective from 10th of August 2021 until further notice. A number of confirmed bookings are expected to be cancelled or rolled to later sailings as a result of these safety measures. Stockwells will do all we can to keep our original bookings but some cancellations will be out of our control. Getting space on vessels from these ports will also become extremely challenging in the next few months so please notify us of bookings and cargo ready dates as early as possible. Ideally we will need to know the cargo ready date one month in advance.

Shipping Lines Cosco and OOCL have advised: Due to Singapore transshipment congestion and vessels delay, with immediate effect, bookings ex China origins to ADL/FRE are suspended until further notice. At this stage few shipping lines are still accepting bookings ex China to Adelaide and Fremantle.

All carriers have stopped accepted bookings ex India to Australia until further notice. We have been told this is due to severe port congestion at Singapore, where there is currently over 4 weeks’ worth of backlogged containers waiting to be shipped to Australia.

Majority shipping lines have all suspended booking acceptance on all South-East Asia services that are t/s via Singapore. This is due to the situation currently unfolding in Singapore where vessels are waiting over a week to birth due to severe port congestion combined with backlogs and container rollovers for over 4 weeks for services ex Singapore to Auckland. Stockwells will advise when booking acceptance will resume but this may not be for a while, unfortunately.

MSC, Maersk and Hamburg have 3 upcoming services where they will omit Yokohama, Osaka, Busan, Ningbo and Yantian. These three services are back to back, departing NEA the first three weeks of August. This is going to take a significant amount of space out of the market from these ports so demand for space from other carriers is going to go increase.

Due to the huge number of recent service omissions from Qingdao it has become impossible to get space with a number of carriers. Please contact us ASAP of new shipments at least 5 weeks from the cargo ready date as we have very limited options in who we can book space with.

Services between Australia and New Zealand have been impacted in recent months by severe port congestion at both AU and NZ ports. In order to reduce delays caused by this port congestion, shipping lines operating on this trade lane reduced space capacity on services, deliberately omitted the ports with the biggest delays (Sydney, Auckland) and blanked a number of sailings. This has left a huge backlog of cargo unable to be shipped on AU-NZ services with shipping lines refusing to add extra services to clear the backlog. Below is an update on Each carrier.

- ANL – Fully booked until the end of August. September services not yet open for booking.

- MSC – Fully suspended booking acceptance until further notice.

- Hamburg Sud – Fully booked until the end of August.

- Hapag Lloyd – Fully booked to mid-September with bookings not being accepted beyond then.

- Maersk – no services available for booking.

Only a few carriers right now are accepting bookings ex North China (Xingang, Dalian) due to space and equipment issues. Other carriers have very small allocations from these ports as they are not on direct routes.

USA Service Delays

Terminals

US East Coast

Please see below vessel waiting time at terminals due to high import volume.

Philadelphia: 8-12 hours

New York Container Terminals: 24-48 hours

Savannah: 6 days

Charleston: 0-12 hours

US West Coast

Please see below vessel waiting time at terminals due to high import dwell and labor shortages.

Los Angeles: 8-10 days

Long Beach: 6-9 days

Seattle: 10 days

Oakland: 4-6 days

US Golf Coast

New Orleans: 24 hrs

Houston: 24-72 hrs

Rail Terminals

There are increasing chassis shortages causing major delays in the pickup and delivery of containers. It is expected that dwell times will increase due to rail car shortages, gate capacity restrictions, and limited reservations at major rail facilities.

Philadelphia, Charleston, Chicago, Chicago Rail Ramp, BNSF & UP/ LAX/LGB BNSF are all being affected by severe shortages of available chassis resulting in delayed pickups, deliveries, and drays.

General Rate Increases, Peak Season Surcharge & Congestion Surcharge

General Rate Increases:

Stockwell International has received notice that there have been global FCL and LCL general rate increases. For specific countries and amounts please contact us directly.

1st July 2021

India, Pakistan and Sri Lanka to Australia and New Zealand

Amount: USD $500/TEU and USD $1000/FEU

1th August 2021

North East Asia to Australia

Amount: FCLUSD $750

LCL USD $30.00 per W/M or Minimum

1st August 2021

USA, Canada and Mexico to Australia and New Zealand

Amount: USD $200/TEU

1st August 2021

All North American CFS Australia – Brisbane & Fremantle

Amount: USD $8 w/m

1st August 2021

All North American CFS Australia – Melbourne & Sydney

Amount: USD $2 w/m

1st August 2021

Atlanta, Baltimore, Boston, Charleston, Charlotte, Memphis, Miami, Norfolk, New York, Philadelphia, San Juan New Zealand – Auckland & Wellington

Amount: USD $8 w/m

1st August 2021

South Africa to Australia and New Zealand

Amount: FCLUSD $250/TEU

1st September 2021

USA to Australia and New Zealand

Amount: USD $1000 per reefer TEU

1st September 2021

Latin America to Australia and New Zealand

Amount: USD $200 per reefer TEU

10th September 2021

North Europe & Mediterranean ports to Australia & New Zealand

LCL USD $72

17th September 2021

North America – Brisbane USD $20 w/m

North America – Fremantle USD $30 w/m

Atlanta, Baltimore, Boston, Charleston, Charlotte, Memphis, Miami, Montreal, New York, Norfolk, Philadelphia & San Juan CFS – Sydney / Melbourne / Adelaide USD $20 w/m

Atlanta, Baltimore, Boston, Charleston, Charlotte, Memphis, Miami, Montreal, New York, Norfolk, Philadelphia & San Juan CFS – Auckland, Christchurch, Lyttlelton & Wellington USD $ 20 w/m

13th September 2021

East coast USA – Sydney, Brisbane, Melbourne, Adelaide, Fiji, French Polynesian, New Caledonia New Zealand, Papua New Guinea USD $20 w/m

11th September 2021

ALL US Origins – Fremantle USD $30 w/m

Los Angeles, Portland, San Francisco, Seattle – Djibouti, India, Middle East, Tanzania USD $40 w/m

All US Origins – Mauritius USD $60 w/m

All US Origins – Brazil, Zambia, Zimbabwe USD $40 w/m

All US Origins – Paraguay USD $4 w/m

12th September 2021

Los Angeles, Long Beach, Seattle, Tacoma, San Francisco and Oakland – India, Bangladesh, Pakistan, Sri Lanka, Oman, Qatar, United Arab Emirates, Kuwait, Saudi Arabia USD $40 w/m $40 min

1st October 2021

All Australian ports – All New Zealand Ports

USD $200 per 20′ | USD $400 per 40′ dry containers

LCL – AU $7.00 per w/m or minimum

Peak Season Surcharge:

1st August 2021

China, Macau and Hong Kong to Australia

FCLUSD $500/TEU and USD $1000/FEU

1st September 2021

Taiwan to Australia

FCLUSD $500/TEU and USD $1000/FEU

1st September 2021

Auckland, via Auckland to Australia

Amount: USD $5 w/m

Peak Season Surcharge:

22nd July 2021

Australia and New Zealand to Fuzhou

FCLUSD $1500 per reefer container

16th August 2021

China, Japan, North Korea, South Korea, Taiwan, Hong Kong, Macau, Mongolia to Melbourne, Sydney, Brisbane

Amount: USD $750 per 20’ standard container USD $1,500 per 40’ standard and high cube container

15th August 2021

North Asia to Australia

Amount: USD $30 w/m

10th September 2021

North Europe & Mediterranean ports to Australia & New Zealand

FCL USD $1,200 per 20′ | USD $2,400 per 40′

LCL USD $48 w/m

9th September 2021

North Europe to Australia

USD $750 per 20’RF | USD $1,500 per 40’RF & RH

1st September

Ex Antwerp to Australia

EUR 90.00 per w/m

Congestion Surcharge:

1st August 2021

All US origins to all destinations

LCL USD $10 w/m

29th August 2021

Chicago, Cincinnati, Cleveland, Columbus, Detroit, Indianapolis, Milwaukee, Minneapolis, Seattle, Portland to all destinations

LCL USD $20 w/m

1st August 2021

All origins to all US destinations

LCL USD $10 w/m

1st August 2021

All origins to and via Los Angeles

LCL USD $12 w/m

29th August 2021

All origins to and via Chicago

LCL USD $20 w/m