Future changes to import conditions for cork and cork products

Stockwell International has received information regarding future changes to import conditions for cork and cork products.

Upcoming changes to the Biosecurity (Conditionally Non-prohibited Goods) Determination 2021 (Goods Determination) will be made for cork and cork products. This is part of the Department of Agriculture, Fisheries and Forestry (the department’s) ongoing review of the currency and effectiveness of import conditions and the appropriate application of import permits to manage biosecurity risk appropriately.

To reflect the Goods Determination changes, the department will also update the relevant BICON cases for these products. It is important to note that importers of unprocessed cork may require an import permit to import their goods. You can determine if you will require an import permit from the below information. If you determine that you will require an import permit, or are unsure about whether you will require an import permit, please contact the department by emailing [email protected] (please use the subject ‘Plant Tier 2 – cork import conditions’) for advice.

The exact date of the Goods Determination update is not yet known, but it is likely to occur in or after August 2022. The department will keep importers informed of the exact date for the change via future advice notices.

Goods that arrive in Australia on or after the day that the changes are made to the Goods Determination must comply with the new conditions.

Import conditions found in the Cork and cork products BICON case will be updated to recognise the difference in biosecurity risk of unprocessed cork compared to processed cork and cork products. Note: Importers of unprocessed cork may require an import permit to import their goods.

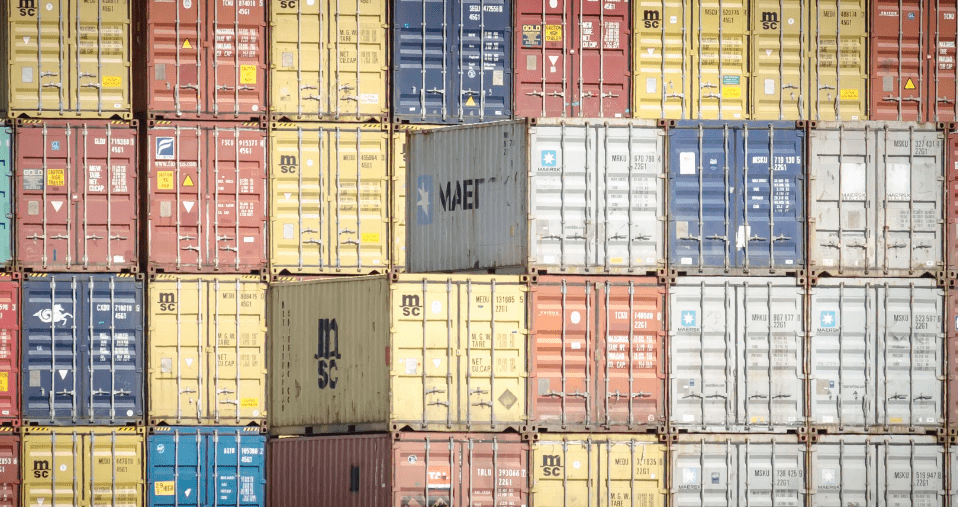

NEWS: Sydney Empty Container Congestion Spikes a Broken System

By: Container Transport Alliance Australia

Empty shipping container congestion has spiked again in Sydney in recent weeks, leaving importers and their transport providers incurring added costs from empty de-hire delays, yard storage of empties, futile trucks trips, and additional administration.

The congestion and delays come off the back of a relatively positive month in June when over 80,000 TEU (Twenty Foot Equivalent Units) of empties were evacuated by shipping lines through Port Botany, with a Load/Discharge Ratio of 1.07.

Unfortunately since then, weather events in Sydney have led to unforeseen reductions in the movement of empty containers away from Port Botany, leaving the main Empty Container Parks (ECPs) at or near capacity. The ECPs have not been able to accept additional empty equipment for their client shipping lines and are asking importers / transport operators to contact shipping lines for de-hire alternatives, which are not forthcoming.

The empty container chain in NSW is unfortunately broken. It takes only slightly higher import volumes, caused in large part by off-window vessel arrivals and bunching, and larger container exchanges from those vessels, coupled with delays due to weather events or other issues impacting on ECP capacity, and the system becomes chaotic and unsustainable.

Trucks are literally driving from ECP to ECP looking for a de-hire location, only to be told by ECP operations staff that they aren’t accepting that equipment anymore due to capacity constraints, or that a redirection has been notified. This is despite the transport operator having a valid Notification Window slot booking through the Containerchain truck-arrival notification system which aren’t being accepted in good faith.

CTAA has seen numerous email exchanges with shipping lines where they have been unable to advise an alternative de-hire option, yet they are also reluctant to issue immediate waivers or extensions to container detention fee policies even though they cannot offer adequate de-hire capacity.

Update to surveillance and testing of meat and other animal products by Australian Border Force

Stockwell International have received information regarding the increase of surveillance and testing of meat and other animal products, both at the border and through targeted checking of retail outlets.

Some pork products have been removed from supermarket shelves after viral fragments of both foot and mouth disease (FMD) and African swine fever (ASF) were detected during testing. This find does not change Australia’s disease-free status for FMD and ASF. There is no threat to human health from these diseases.

Following these incidents, the government will continue to step up this surveillance activity and will prosecute breaches of biosecurity rules to the full extent of the law. This is across all pathways, not just travellers through airports.

Breaches of Australia’s biosecurity are taken very seriously. Penalties for those who do the wrong thing include imprisonment for up to 10 years or a fine of up to $1,110,000 (or $5,550,000 for corporate entities) or both.

For more information the department can be contacted on 1800 900 090.

Western Australia Terminal Congestion and Delivery Delays Update

Stockwell International would like to provide our clients an update on terminal congestion and delivery delays in Western Australia.

Due to continued effects of Covid-19, industrial action, port closures our team is seeing on-going congestion and delays in Western Australia that are resulting in potential additional charges for wharf storage, empty container detention and other related costs.

In addition to this, limited availability of slots at wharf/ empty container parks and congestion caused by high volumes that are beyond our control.

Stockwell International will continue to monitor and update you on the developing situation and endeavour to make this period as uncomplicated as possible.

If you have any further questions, please contact [email protected]

Fuel Surcharge

Air Freight

NOTE: Stockwell International would like to inform you that import and export air handling / terminal fees are increasing due to market costs going up.

Stockwell International would like to inform you of the updated fuel surcharge for the month of July.

Effective July 1st 2022

For the East Coast of Australia, the fuel surcharge will be at 22%.

Effective June 1st 2022

South Australia, our fuel surcharge will now be 32% for metro transport in Adelaide.

Western Australia, our fuel surcharge will be 30% for metro transport in Perth and Fremantle.

Stockwell International will endeavour to keep you updated with the most recent information as it become available to us.

For any other questions or enquiries please contact [email protected]