The post Stockwell International Urgent News Alert 15 January 2024 appeared first on webfx.

]]>Please note congestion is causing severe delays to trans-shipments at the port of Singapore. Shipping lines have notified Stockwells that delays could be as long as 4 weeks at present with shipments from South-East Asia and Europe being most severely impacted.

Please note, any additional charges that incur as a result of this delay will not be the responsibility of Stockwell International.

Weather: USA Winter Storm Gerri

Winter Storm Gerri is forecasted to produce severe conditions including heavy snow, strong winds, and flooding rains across the Midwest and Northeast segments of our network beginning this past Friday and continuing through early Saturday morning.

The most substantial impacts in the Midwest will likely be the combination of snow and wind which could lead to limited visibility, while the Northeast may experience a combination of snow and heavy rain – with flooding being a possibility.

Terminals will continue to operate under normal hours and Norfolk Southern will monitor the storm closely and take precautions to protect employees, track, and shipments as needed.

Stockwell International will continue to keep clients updated with any impacts this storm may have.

Read More | Freezing US winter storms threaten to break low-temperature records | US weather | The Guardian

DP World Industrial Action Update

The DP World Industrial Action is still on-going and is predicted to continue until the 22nd of January 2024. Below are the planned stoppages at the ports.

Brisbane

Quayside will stop between 07:00hrs and 15:00hrs from Monday 15th Jan 07:00hrs through to Monday 22nd Jan 07:00hrs. All receival and delivery will stop from Monday 15th Jan at 07:00hrs until Tuesday 16th Jan 07:00hrs. All receival and delivery will stop from Friday 19th Jan 07:00hrs through to Saturday 20th Jan 07:00hrs.

Sydney/Melbourne

Quayside will stop between 06:00hrs and 14:00hrs from Monday 15th Jan 06:00hrs through to Monday 22nd Jan 06:00hrs. All receival and delivery will stop from Monday 15th Jan 06:00hrs until Tuesday 16th Jan 06:00hrs. All receival and delivery will stop from Friday 19th Jan 06:00hrs through to Saturday 20th Jan 06:00hrs.

Fremantle

Quayside will stop between 06:00hrs and 14:00hrs from Monday 15th Jan 06:00hrs through to Monday 22nd Jan 06:00hrs. All receival and delivery will stop from Monday 15th Jan 06:00hrs until Tuesday 16th Jan 06:00hrs. All receival and delivery will stop from Friday 19th Jan 06:00hrs through to Saturday 20th Jan 06:00hrs.

Stockwell International will continue to keep clients up to date with any new information we receive.

Chinese New Year – How to best prepare your supply chain

It is no secret that China dominates in global manufacturing and export industries. As a result, much of the globe has come to rely heavily on this ‘World Factory’, which is why businesses worldwide need to take heed and prepare for the upcoming Chinese New Year holiday.

Chinese New Year will commence on February 10th, 2024, and end on February 17th, 2024. Nevertheless, many production sites will begin to decelerate and close down up to a month prior as this significant tradition is the only holiday where people get to spend extended time with their families.

As many ports, factories and production sites close, it can disrupt supply chains and impact the logistics of businesses. Preparing ahead of time will allow you to minimise the disruption of delays in your supply chain management system.

Challenges to expect:

Factory closures halt goods delivered from factories to ports, and ports will function at a lower capacity due to the seasonal shipping rush from Chinese New Year closures. Ocean freight services may be full or overbooked earlier than usual, causing challenges in securing container space as carriers will be in high demand. As a result, this will increase rates for freight and other delivery services in and out of China. What you can do to avoid stressing your supply chain: If you want to avoid disruptions in your supply chain, placing orders well before the Chinese New Year is best. By preparing in advance and being mindful of deadlines, you can ensure your freight delivery runs smoothly.

Check-in with your manufacturer:

Consult with your manufacturer and factories ahead of time on closures and final shipment dates to confirm that your supplies will reach you before the holiday. By booking your ocean freight at least three weeks in advance, you will have time to plan for any potential production delays and avoid disruptions in your supply chain.

Organise your inventory to overcome delays or shortages:

The ramifications of delays in shipping and manufacturing can be long-lasting. If you’re receiving shipments from China, it’s best to communicate closely with your supplier. The dates of these shipments can change in the weeks leading up to Chinese New Year, as factories are working at full capacity. Ensure you have alternatives, such as organising inventory to avoid shortages due to delayed or slow shipments.

With proper planning and communication, you can prepare your supply chain for the impacts of the Chinese New Year, ensuring that you can continue serving your customers during this time. By working with freight services providers, freight forwarders, port authorities and logistics experts, you can mitigate any potential disruptions and ensure seamless operations during this period of production closures.

Need to get your stock moving quickly? Talk to Stockwell about our air freight options. Our connections with major global airlines provide us with a wide range of freight forward solutions allowing us to move cargo fast and efficiently.

Get in touch with your logistics partner:

Having a trusted and reliable logistics partner with the expertise and resources to help clear any complications during the Chinese New Year period will not only ease seasonal shipping stress but ensure that your products reach you and your customers on time.

Get in touch with the Stockwell International team today, we can help with your freight booking needs, and the in-house booking office can arrange all your FCL movements in the lead up to and around Chinese New Year.

Contact [email protected] or head to our website www.stockwells.com.au to speak to our helpful team.

FCL & LCL Red Sea Surcharge, Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

LCL Booking Fee

Effective 1st January,2024

LCL: $45

GRI

Effective January 1st 2024

North East Asia to Australia

Per TEU | $300

—————————————————————

RED SEA CHARGES

FCL Red Sea Surcharge

Effective Immediately

USD1550-1600 on everything from Europe (including cargo on the water).

LCL Red Sea Surcharge

Effective Immediately

$65 w/m

Operational Cost Recover Surcharge

*Import and Export Surcharges applicable for sailings effective 1st January, 8th January and 15th January 2024*

Effective 1 January 2024

Europe & Mediterranean to New Zealand

USD 35.00

New Zealand to Europe & Mediterranean

USD 40.00

Effective 8 January 2024

New Zealand to Europe & Mediterranean

USD 55.00

New Zealand to Middle East

USD 55.00

Effective 15 January 2024

New Zealand to Europe & Mediterranean

USD 75.00

Gulf of Aden/Red Sea Surcharge

Effective 1 January 2024

All Red Sea Ports** to New Zealand

USD 20.00

Effective 8 January 2024

(addition to OCR)

All Red Sea Ports** to New Zealand

USD 40.00

Effective1 January 2024

New Zealand to All Red Sea Ports**

USD 20.00

Effective 8 January 2024

(addition to OCR)

New Zealand to All Red Sea Ports**

USD 40.00

** Red Sea Ports Include: From/To Jeddah, Port of Neom, Djibouti, Aden. Hoedeidah, Port Sudan, Massawa, Berbera, Aqaba, Sokna

—————————————————————-

Southbound Rate Restoration

BAF Charges

Low Sulphur Adjustment (LSA) – Effective January 1st, 2024

Asia to Australia

Southbound – USD

20’GP – 202

40’GP/HQ – 404

20’RF – 303

40’RQ – 606

Northbound- USD

20’GP – 95

40’GP/HQ – 190

20’RF – 143

40’RQ – 285

Asia to New Zealand

Southbound – USD

20’GP – 210

40’GP/HQ – 420

20’RF – 315

40’RQ – 630

Northbound- USD

20’GP – 156

40’GP/HQ – 312

20’RF – 234

40’RQ – 468

Australia to New Zealand

Southbound – USD

20’GP – 77

40’GP/HQ – 154

20’RF – 116

40’RQ – 231

Northbound- USD

20’GP – 164

40’GP/HQ – 328

20’RF – 246

40’RQ – 492

Panama Canal Low Water Surcharge (PLW)

Effective January 1, 2024

USD 255.00/20′ container

USD 300.00/40′ container

FURTHER UPDATED Transport Wharf Charges

Effective January 1st, 2024

Sydney

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $160.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $125.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $130.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Container Park Fee $110.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $50.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $110.00

Infrastructure Fee $95.00

Empty Container Park Fee $125

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1.

The post Stockwell International Urgent News Alert 15 January 2024 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 20 December 2023 appeared first on webfx.

]]>In recent weeks, the global shipping industry has faced significant disruptions due to escalating drone attacks on vessels navigating the Red Sea. These attacks have prompted major shipping companies like Maersk, Hapag-Lloyd, CMA CGM, and MSC to suspend passage through this maritime route until further notice.

Several major shipping companies, responsible for transporting a diverse range of goods including food, clothing, pharmaceuticals, industrial machinery, and energy supplies, have made the cautious yet imperative decision to halt passage through the Red Sea. This strategic waterway serves as a crucial link between the Mediterranean Sea via the Suez Canal, facilitating approximately 10% of the world’s trade.

The implications of this disruption extend globally, the Australian Peak Shippers Association and Freight and Trade Alliance have highlighted the repercussions for Australia’s trade, citing the potential for increased transit times, additional surcharges, and heightened costs for goods.

These attacks have led to increased insurance costs and concerns regarding the safety of vessels and their crews. As a consequence, prolonged closure or heightened risk in the Red Sea could further elevate expenses, especially affecting the supply of oil and natural gas, already strained by wider inflationary pressures.

The effects on transit times are expected to be substantial, potentially adding up to 10 days to shipments destined for North Europe and Mediterranean ports. Furthermore, the potential withdrawal of insurance policies for vessels passing through this region or the declaration of the Red Sea as a ‘war zone’ could limit shipping lines’ options, significantly impacting international trade flows.

While the global oil market has, for now, absorbed these attacks with prices remaining relatively stable, the overall concern revolves around weakened demand in major economies rather than immediate market volatility.

In summary, the current situation underscores the fragility of global supply chains and the interconnectedness of international trade. As discussions and engagements continue to address the safety concerns in the Red Sea region, the impact on shipping schedules, costs, and the availability of goods remains a concern.

We can only monitor this evolving situation and prepare for potential adjustments in shipping schedules, costs, and overall trade dynamics in the coming days.

Given the fallout from the Ever Given being stranded in the Suez Canal in March 2021, this current suspension of passage through the Red Sea is likely to have an instant impact on global rates and transit delays and serves as a stark reminder of the vulnerabilities within international shipping routes.

We understand the potential concerns and challenges this situation may pose to your operations and supply chains and encourage you to reach out to your Customer Service Report or Key Account Manager with any questions or concerns you might have regarding the impact on your shipments, schedules, and pricing.

EU Emissions Trading System (ETS) Introduced from January 1st, 2024

Stockwell International would like clients to be aware of the introduction of a new surcharge coming in from Europe in the new year – Emissions Trading System surcharge.

What is the EU ETS?

The EU ETS, or Emissions Trading System, sets a “cap” on the emissions that companies in certain industries produce and requires them to obtain allowances that equal their emissions above the cap at the end of each year. As other industries under the EU ETS do today, Shipping lines will now need to purchase and surrender ETS emission allowances, or EU Allowances (EUAs), for each ton of CO2 emissions reported under the scope of the system.

Where does EU ETS apply to shipping emissions?

All emissions from ships calling at an EU port for voyages within the EU (intra-EU) as well as 50% of the emissions from voyages starting or ending outside of the EU (extra-EU voyages), and all emissions that occur when ships are at berth in EU ports will come under the remit of the EU ETS. A phased-in approach of EU ETS will be implemented for our industry over the next three years that will see 40% of total verified emissions calculated from 2024, 70% in 2025, and 100% in 2026.

It will be charge at EUR 48/teu (please note this cannot be included in freight, and it will be charged as a subject to charge)

For any further information, please contact [email protected].

Chinese New Year 2024 – Space Becoming Limited

Chinese New Year is fast approaching and Stockwell International would like clients to be aware of the notification we are receiving regarding limited space available in the lead up to the CNY holiday period.

If you are needing to book space on a vessel to arrive before or during the CNY period, please contact your Key Account Manager or Customer Service Representative.

For further information, contact [email protected].

Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

LCL Booking Fee

Effective 1st January,2024

LCL: $45

GRI

Effective January 1st 2024

North East Asia to Australia

Per TEU | $300

Southbound Rate Restoration

BAF Charges

Low Sulphur Adjustment (LSA) – Effective January 1st, 2024

Asia to Australia

Southbound – USD

20’GP – 202

40’GP/HQ – 404

20’RF – 303

40’RQ – 606

Northbound- USD

20’GP – 95

40’GP/HQ – 190

20’RF – 143

40’RQ – 285

Asia to New Zealand

Southbound – USD

20’GP – 210

40’GP/HQ – 420

20’RF – 315

40’RQ – 630

Northbound- USD

20’GP – 156

40’GP/HQ – 312

20’RF – 234

40’RQ – 468

Australia to New Zealand

Southbound – USD

20’GP – 77

40’GP/HQ – 154

20’RF – 116

40’RQ – 231

Northbound- USD

20’GP – 164

40’GP/HQ – 328

20’RF – 246

40’RQ – 492

Panama Canal Low Water Surcharge (PLW)

Effective January 1, 2024

USD 255.00/20′ container

USD 300.00/40′ container

FURTHER UPDATED Transport Wharf Charges

Effective January 1st, 2024

Sydney

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $160.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $125.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $130.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Container Park Fee $110.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $50.00

Sideloader Levy $120.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $110.00

Infrastructure Fee $95.00

Empty Container Park Fee $125

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $120.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1.

The post Stockwell International Urgent News Alert 20 December 2023 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 12 December 2023 appeared first on webfx.

]]>Stockwell International would like clients to be aware of the introduction of a new surcharge coming in from Europe in the new year – Emissions Trading System surcharge.

What is the EU ETS?

The EU ETS, or Emissions Trading System, sets a “cap” on the emissions that companies in certain industries produce and requires them to obtain allowances that equal their emissions above the cap at the end of each year. As other industries under the EU ETS do today, Shipping lines will now need to purchase and surrender ETS emission allowances, or EU Allowances (EUAs), for each ton of CO2 emissions reported under the scope of the system.

Where does EU ETS apply to shipping emissions?

All emissions from ships calling at an EU port for voyages within the EU (intra-EU) as well as 50% of the emissions from voyages starting or ending outside of the EU (extra-EU voyages), and all emissions that occur when ships are at berth in EU ports will come under the remit of the EU ETS. A phased-in approach of EU ETS will be implemented for our industry over the next three years that will see 40% of total verified emissions calculated from 2024, 70% in 2025, and 100% in 2026.

It will be charged at EUR 48/teu (please note this cannot be included in freight, and it will be charged as a subject-to-charge)

For any further information, please contact [email protected].

DP World Industrial Action Update

Stockwell International would like to provide further updates on the impending Industrial Action across the DP World Terminals.

The CFMMEU has given notice to DP World of further Protected Industrial Action through to the 18th December 2023.

Please note any delays or congestion that result in additional charges will not be the responsibility of Stockwell International.

Chinese New Year 2024 – Space Becoming Limited

Chinese New Year is fast approaching and Stockwell International would like clients to be aware of the notification we are receiving regarding limited space available in the lead up to the CNY holiday period.

If you are needing to book space on a vessel to arrive before or during the CNY period, please contact your Key Account Manager or Customer Service Representative.

For further information, contact [email protected].

NEWS: Shipping companies offering millions to jump long lines for drought-stricken Panama Canal

Fox Weather | Chris Oberholtz

Shipping companies are opening up their pocketbooks in desperate attempts to get their cargo through the Panama Canal in a timely manner, as the canal faces an unprecedented drought, causing its lowest water levels since the mid-1900s.

The result has been a severe reduction in the canal’s transit capacity and a line that’s now dozens of ships long waiting to get through.

Nearly 80 ships aiming to pass through the canal connecting the Pacific and Atlantic oceans are instead dealing with significant delays and losses for businesses, affecting the trade of energy, consumer goods and food.

It takes about 8 to 10 hours to transit the 50-mile-long canal, compared to several weeks to travel around South America’s Cape Horn. But now ships are waiting about 1-2 weeks in line, depending on which way they’re headed.

Some companies have decided they can’t afford the wait, and will now pay exorbitant amounts to bypass the queue, creating competition among vessels.

“Many of them have been LNG shipments (liquefied natural gas) going to Asia as we heard toward the heart of winter,” Everstream Analytics chief meteorologist Jon Davis told FOX Weather.

According to Davis, numerous reports have been of firms paying as much as $4 million to move to the front of the line, thus bypassing the wait times.

“Everyone in the market is very aware of this, and other vessels that have also jumped the line,” he adds.Read More | Shipping companies bid millions to jump lines for drought-stricken Panama Canal (foxweather.com)

Please Note: Due to the unprecedented drought in the Panama Canal, shipping lines have put in place a new Panama Canal Low Water Surcharge (PLW) that will come into effect January 1, 2023.

USD 255.00/20′ container

USD 300.00/40′ container

Any further questions please contact [email protected].

NEWS: Tropical Cyclone Jaspar prompts Queensland weather warnings for wild winds, heavy rain, possible flooding

ABC | AAP

Residents of far north Queensland are bracing for wild weather, possible power outages, and internet and water supply disruptions with the arrival of Tropical Cyclone Jasper.

As of 4.30am on Monday, Jasper had weakened again to a category 1 system and was about 600km east of Cairns and 530km northeast of Townsville.

“Jasper is forecast to re-intensify during Tuesday as it approaches the coast,” the Bureau of Meteorology said.

The bureau currently predicts Jasper will make landfall between Cape Flattery and Cardwell, which are north and south of Cairns, respectively, potentially as a category 2 system. The forecast tracker map suggests it might hit Port Douglas, with people living between Cooktown and Ingham are being warned to expect damaging 90km/h winds to develop from Tuesday.

The winds could extend as far north as Cape Melville, on the eastern coast of Cape York Peninsula, and as far south as Townsville, the Bureau of Meteorology warned.

Heavy rainfall is also expected to develop along the coast from late Tuesday.

Flooding is possible for the north tropical coast, parts of the Cape York peninsula and Gulf Country from Wednesday, the bureau warned.

A severe weather warning for damaging winds was also in place for Monday in parts of the Herbert, lower Burdekin, central coast and Whitsundays districts, with the bureau predicting gusts of up to 90km/h in some areas.

Queensland Fire and Emergency Services on Sunday warned residents between Cape Melville and Townsville strong winds could fell trees and powerlines, lift roofs off houses and blow away anything not tied down.

Jasper could also cause phone and internet outages, along with water supplies, the services warned.Read More | Tropical Cyclone Jasper prompts Queensland weather warnings for wild winds, heavy rain, possible flooding | Queensland | The Guardian

NEWS: Heavy snow and wind causes chaos across Europe and US, shutting down flights and rail

By ABC

Snowstorms and heavy winds have caused chaos across parts of Europe and the US, grounding flights at Munich’s airport and knocking out power across the US’s Pacific Northwest.

Here’s a look at how cities and nations have been affected so far.

Germany

Munich’s airport cancelled all flights until 6am Sunday local time.

Trains to and from Munich’s central station were halted, Germany’s national railway said, advising passengers to delay or reroute their journeys.

The news agency DPA reported some passengers in Munich and the nearby city of Ulm spent Friday night on trains due to the halt.

In the Bavarian capital, no buses or trams were operating as of Saturday afternoon, the local transit authority said.

Downed trees also left “many thousands” of people without power across the state of Bavaria, the utility company Bayernwerk told DPA.

Officials for Germany’s Bundesliga also announced a soccer match between Bayern Munich and Union Berlin, originally scheduled for Saturday afternoon in Munich, was cancelled.

US

Thousands of households were without power on Saturday morning in thegreater Seattle area after a night of rain and wind, the Seattle Times reported.

Seattle City Light reported 17 outages affecting more than 1,700 customers, roughly two-thirds of them in South Seattle, according to the utility’s outage map.

In Oregon, more than 2,000 customers in the Portland area also lost power, outage maps from Portland General Electric and Pacific Power showed.

The power cuts came as high winds swept across the region, reaching 84 kilometres per hour at Seattle-Tacoma International Airport, according to the National Weather Service’s Seattle office.

The storms also brought snow to the Cascades.

As of Friday afternoon, Paradise in Mount Rainier National Park had received 14 inches (35.5 centimetres) of snow over 24 hours, according to preliminary reports from the National Weather Service.

Snowfall and heavy wind too caused the cancellation of a men’s World Cup downhill skiing race on Saturday in Colorado.

The cancellation made it the fourth downhill that has been scrapped because of the weather early in the World Cup season, following two in Switzerland in early November and one early in Colorado.

Switzerland & Austria

The Zurich airport reported weather-related delays, as new snowfall led officials to raise the alarm about the danger of avalanches.

The provinces of Tyrol and Vorarlberg in western Austria raised their avalanche warnings to the second-highest level after the region received up to 50 centimetres of snow on Saturday night.

The Austrian railway company OeBB said Saturday afternoon various stretches of its routes across the country were closed due to the storm.

Czech Republic

In the Czech Republic, the major highway and some other roads were blocked for hours and more than 15,000 households were without power.

The key D1 highway that links the capital Prague with the second largest city ofBrno was in a standstill for hours after an accident that caused a 20-kilometre long line of trucks.

A number of high-speed and regional trains had to stop in the southern part of the country as cross-border trains from neighbouring Austria and Germany did not operate.

Read | Heavy snow and wind causes chaos across Europe and US, shutting down flights and rail – ABC News

EDI Fee Increase, Industrial Action Surcharge (Cost Recovery), Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

EDI FEE INCREASE

Effective 1st November

FCL | $24.00

LCL/Air | $13

Industrial Action Surcharge (Cost Recovery)

Effective 22nd November 2023

20ft Containers in and out of DP World – $50.00 per container

40ft Containers in and out of DP World – $100.00 per container

The fee calculated above is a recovery of actual costs only and will be reviewed in January 24 when the congestion is meant to have cleared out if Industrial action is finalised.

LCL Booking Fee

Effective 1st January

LCL: $45

GRI

Effective January 1st 2024

North East Asia to Australia

Per TEU | $300

Southbound Rate Restoration

BAF Charges

Low Sulphur Adjustment (LSA) – Effective January 1st, 2024

Asia to Australia

Southbound – USD

20’GP – 202

40’GP/HQ – 404

20’RF – 303

40’RQ – 606

Northbound- USD

20’GP – 95

40’GP/HQ – 190

20’RF – 143

40’RQ – 285

Asia to New Zealand

Southbound – USD

20’GP – 210

40’GP/HQ – 420

20’RF – 315

40’RQ – 630

Northbound- USD

20’GP – 156

40’GP/HQ – 312

20’RF – 234

40’RQ – 468

Australia to New Zealand

Southbound – USD

20’GP – 77

40’GP/HQ – 154

20’RF – 116

40’RQ – 231

Northbound- USD

20’GP – 164

40’GP/HQ – 328

20’RF – 246

40’RQ – 492

Panama Canal Low Water Surcharge (PLW)

Effective January 1, 2023

USD 255.00/20′ container

USD 300.00/40′ container

Transport Wharf Charges

Effective January 1st, 2023

Sydney

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $160.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $110.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $90.00

Infrastructure Fee $235.00

Empty Container Park Fee $125.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $110.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Container Park Fee $130.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $110.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Container Park Fee $110.00

(Was previously known as Empty Booking Fee)

Weighbridge Fee $50.00

Sideloader Levy $110.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $110.00

Infrastructure Fee $95.00

Empty Container Park Fee $125

(Was previously known as Empty Booking Fee)

Weighbridge Fee $20.00

Sideloader Levy $110.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1

The post Stockwell International Urgent News Alert 12 December 2023 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 1 December 2023 appeared first on webfx.

]]>Stockwell International would like to provide further updates on the impending Industrial Action across the DP World Terminals.

The CFMMEU has given notice to DP World of further Protected Industrial Action through to the 11th December 2023.

The Protected Industrial Action will continue with work related stoppages and bans across the four DP World Terminals. Stoppage include 1hour, 2hour stoppages per day and 24hour stoppage on receival and delivery plus bans on the performance of overtime, extensions, upgrades etc.

24hour stoppage will take effect across all four DPW terminals (Sydney, Brisbane, Melbourne & Fremantle) which are occurring on the same day nationally:

- 24hour stoppage starting 5th December at 0600 and will finish 6thDecember at 0600

- 24hour stoppage starting 6th December at 0600 and will finish 7thDecember at 0600

Reminder: DPW Sydney will have a 24hr stoppage starting 0600 27thNovember and will finish 28th November at 0600.

Please note any delays or congestion that result in additional charges will not be the responsibility of Stockwell International.

Severe Congestion in South Africa’s Ports

Severe congestion in South Africa’s ports is forcing shipping lines to omit the country from their services.

Currently 96 vessels are waiting at anchor outside ports, costing the economy R98m ($5.32m) a day, according to the South African Association of Freight Forwarders (SAAFF).

Maersk is among the lines skipping calls; earlier today it warned of long waiting times at Durban and noted that “CMA has triggered a Cape Town omission on the APL Houston eastbound voyage due to berthing congestion in Cape Town”.

The congestion appears to be the result of a perfect storm of poor weather affecting operations and ports operator Transnet experiencing issues with equipment.

“Simply put, the current situation amounts to at least R48.5m of pure sunken cost just sitting outside at anchorage a day. Furthermore, with the port congestion surcharges for containers awaiting implementation, this figure jumps to R98m. We are already paying nearly 10% more with the current conditions in direct cost.”

SAAFF concluded: “We must improve operational efficiency and increase throughput, or else the trade, transport, and logistics industries will continue to curtail desperately needed economic growth for South Africa.”

EU Emission Trading System (EU ETS)

Stockwell International would like clients to be aware of a new surcharge EU ETS Fee that is being implemented by shippers from January 2024.

In preparation for this new surcharge, Stockwell International wanted to provide you with some information on what the charges is and how it is being structured.

The EU ETS Fee is a result of the integration of the shipping industry in the EU Emission Trading System.

EU ETS will apply to all maritime services with at least one call within the EU: 100% of emissions will be considered for legs between 2 EU ports, only 50% of the emissions for legs between EU ports and non-EU ports.

From January 1st, 2024, shipping lines will be required to report their emissions and purchase an equivalent amount of allowances on the EU ETS market, according to a progressive schedule:

- in 2024, 40% of reported emissions will have to be converted into allowances.

- in 2025, 70% of reported emissions will have to be converted into allowances.

- From 2026, 100% of reported emissions will have to be converted into allowances.

Stockwell International will continue to keep you updated with any changes that may impact shipments.

BMSB Fact Sheet to Download

Stockwell International have put together a fact sheet of everything you need to know about BMSB season which starts September 1st, 2023.

Download our BMSB Fact SheetHERE

If you have any issues downloading your copy, contact [email protected] to have one sent to you!

EDI Fee Increase, Industrial Action Surcharge (Cost Recovery), Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

EDI FEE INCREASE

Effective 1st November

FCL | $24.00

LCL/Air | $13

Industrial Action Surcharge (Cost Recovery)

Effective 22nd November 2023

20ft Containers in and out of DP World – $50.00 per container

40ft Containers in and out of DP World – $100.00 per container

The fee calculated above is a recovery of actual costs only and will be reviewed in January 24 when the congestion is meant to have cleared out if Industrial action is finalised.

GRI

Effective November 15th 2023

China, Hong Kong, Japan, Korea and Taiwan to Australia and New Zealand

Per TEU | $100

Southbound Rate Restoration

PONDUS FEE

Effective 1st October 2023

BAF Charges

Effective November 1st 2023

Asia – North East Asia, South East Asia, West Asia, Europe to Australia

Dry – $180 – $390 USD/TEU

RF – $270 – $580 USD/TEU

Australia to Asia – North East Asia, South East Asia, West Asia

Dry – $70 – $170 USD/TEU

RF – $110 – $250 USD/TEU

Australia to New Zealand

Dry – $50 USD/TEU

RF – $70 USD/TEU

Australia to Europe, Africa

Dry – $140 USD/TEU

RF – $210 USD/TEU

Australia to South Pacific

Dry – $281 USD/TEU

RF – $422 USD/TEU

All Area (Excl. N. & S. America) to New Zealand & South Pacific

Dry – $280 – $600 USD/TEU

RF – $420 – $900 USD/TEU

New Zealand & South Pacific to All Area (Excl. N. & S. America)

Dry – $145 – $310 USD/TEU

RF – $210 – $46 USD/TEU

Transport Wharf Charges

Effective July 1st, 2023

Sydney

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $125.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $130.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Booking Fee $110.00

Weighbridge Fee $50.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $80.00

Infrastructure Fee $85.00

Empty Booking Fee $95.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1

The post Stockwell International Urgent News Alert 1 December 2023 appeared first on webfx.

]]>The post Update to the Australia-Europe Free Trade Agreement: What it Means for Importers appeared first on webfx.

]]>Australia’s aim to secure better terms for its farm exports clashed with the EU’s interests in accessing Australia’s valuable mineral resources for clean energy technologies.

The crux of the issue lies in finding a balance regarding agricultural exports, particularly sheep and beef meat, as well as sugar. While Australia seeks to expand its agricultural exports, European farmers are cautious about potential impacts on their interests.

At Stockwell, we remain committed to providing our clients with support and solutions for your import needs. Our team of experts are well-versed in navigating evolving trade dynamics, ensuring your freight arrives safely and efficiently.

Agreements on the deal are now not expected to be reached until 2025, as negotiations between the EU and Australia continue.

If you require any further information on these updates, feel free to contact our team at [email protected]

The post Update to the Australia-Europe Free Trade Agreement: What it Means for Importers appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 24 November 2023 appeared first on webfx.

]]>Freight & Trade Alliance (FTA) and the Australian Peak Shippers Association (APSA) have received a number of member enquiries expressing concern at Maritime Union of Australia (MUA) stop-work notices announced at terminals other than DP World.

The announcements have no direct link to the protected industrial action between the MUA and DP World, but instead members of the MUA have authorised stop-work to allow attendance of its members to their Annual General Meeting (AGM) being held on Tuesday 28 November. Most major terminals around the country will be impacted as a result.

Following are announcements to date:

DP World

Melbourne – TBC

Brisbane – Terminal will be closed Tuesday 28 November between 0700-1100hrs

Sydney – Terminal will be closed Tuesday 28 November between 1000-1400hrs

Fremantle – TBC

Patrick

Melbourne – Terminal will be closed Tuesday 28 November between 1000-1400hrs

Brisbane – TBC

Sydney – TBC

Fremantle – TBC

Hutchison Ports

Sydney – Terminal will be closed Tuesday 28 November between 1000-1400hrs

Brisbane – TBC

Victoria International Container Terminal (VICT)

Melbourne – VICT will cease road operations during 1000 to 1400 Tuesday 28 November 2023.

* Nb. VICT will also be performing a critical systems outage on Saturday 25 November from 0600. Landside Operations will cease during this time and resume Sunday 26 November at 0600.

Flinders Adelaide Container Terminal

Adelaide – 4 Hour Stop Work Meeting – Tuesday 28th. No VBS slots past 0900hrs. All operations will recommence from 1400hrs.

Remaining terminals yet to announce stoppage times for Tuesday 28 November are expected to make similar announcements in due course, therefore members are encouraged to plan accordingly and liaise with their transport providers.

Please note that any delays or congestion due to this stoppage that result in additional charges will not be the responsibility of Stockwell International.

Victoria International Container Terminal (VICT) – Landside Closure – Saturday 25 November 2023

Stockwell International have received information from VICT regarding a critical systems outage scheduled to run between Saturday 25 November 2023 at 0600 and Sunday 26 November 2023 at 0600.

Please note any additional charges caused during this time will not be be the responsibility of Stockwell International.

DP World Industrial Action Update

Stockwell International have received an update on the DP World Industrial Action.

Further to our previous notice regarding Cybersecurity at DP World Terminals in Australia, we have today received notice that DP World has received a further industrial action notice from CFMMEU from Monday 20th November to Monday 4th December.

The Protected Industrial Action will continue with work related stoppages and bans across the four DP World Terminals on port.

View Full summary of the planned stoppages – DP World Australia;

Summary of planned stoppages

Notice of Upcoming Increases to Terminal and Wharf Charges in 2024

Stockwell International would like to advise of upcoming increases to terminal and wharf charges in 2024. We will advise closer to the time of these increases what the exact costs will be.

For further information, please see the below article from the The Loadstar:

‘Daylight robbery’ – Fury at huge hike in terminal fees by DP World Australia – The Loadstar

EDI Fee Increase, Industrial Action Surcharge (Cost Recovery), Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

EDI FEE INCREASE

Effective 1st November

FCL | $24.00

LCL/Air | $13

Industrial Action Surcharge (Cost Recovery)

Effective 22nd November 2023

20ft Containers in and out of DP World – $50.00 per container

40ft Containers in and out of DP World – $100.00 per container

The fee calculated above is a recovery of actual costs only and will be reviewed in January 24 when the congestion is meant to have cleared out if Industrial action is finalised.

GRI

Effective November 15th 2023

China, Hong Kong, Japan, Korea and Taiwan to Australia and New Zealand

Per TEU | $100

Southbound Rate Restoration

PONDUS FEE

Effective 1st October 2023

BAF Charges

Effective November 1st 2023

Asia – North East Asia, South East Asia, West Asia, Europe to Australia

Dry – $180 – $390 USD/TEU

RF – $270 – $580 USD/TEU

Australia to Asia – North East Asia, South East Asia, West Asia

Dry – $70 – $170 USD/TEU

RF – $110 – $250 USD/TEU

Australia to New Zealand

Dry – $50 USD/TEU

RF – $70 USD/TEU

Australia to Europe, Africa

Dry – $140 USD/TEU

RF – $210 USD/TEU

Australia to South Pacific

Dry – $281 USD/TEU

RF – $422 USD/TEU

All Area (Excl. N. & S. America) to New Zealand & South Pacific

Dry – $280 – $600 USD/TEU

RF – $420 – $900 USD/TEU

New Zealand & South Pacific to All Area (Excl. N. & S. America)

Dry – $145 – $310 USD/TEU

RF – $210 – $46 USD/TEU

Transport Wharf Charges

Effective July 1st, 2023

Sydney

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $125.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $130.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Booking Fee $110.00

Weighbridge Fee $50.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $80.00

Infrastructure Fee $85.00

Empty Booking Fee $95.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1

The post Stockwell International Urgent News Alert 24 November 2023 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 16 November 2023 appeared first on webfx.

]]>Stockwell International have received an update on the DP World Industrial Action.

Further to our previous notice regarding Cybersecurity at DP World Terminals in Australia, we have today received notice that DP World has received a further industrial action notice from CFMMEU extending through until November 27th.

The Protected Industrial Action will continue with work related stoppages and bans across the four DP World Terminals on port. Stoppage include 1hour, 2hour stoppages per day and 24hour stoppage on receival and delivery plus bans on the performance of overtime, extensions, upgrades etc.

View Full summary of the planned stoppages – DP World Australia;

Summary of planned stoppages

We are excited to share our ESG Report which outlines everything we are currently doing and plan to achieve in the Environmental, Social & Governance areas.

Head to Sustainability & Corporate Governance – Stockwells International to find out more!

Notice of Upcoming Increases to Terminal and Wharf Charges in 2024

Stockwell International would like to advise of upcoming increases to terminal and wharf charges in 2024. We will advise closer to the time of these increases what the exact costs will be.

For further information, please see the below article from the The Loadstar:

‘Daylight robbery’ – Fury at huge hike in terminal fees by DP World Australia – The Loadstar

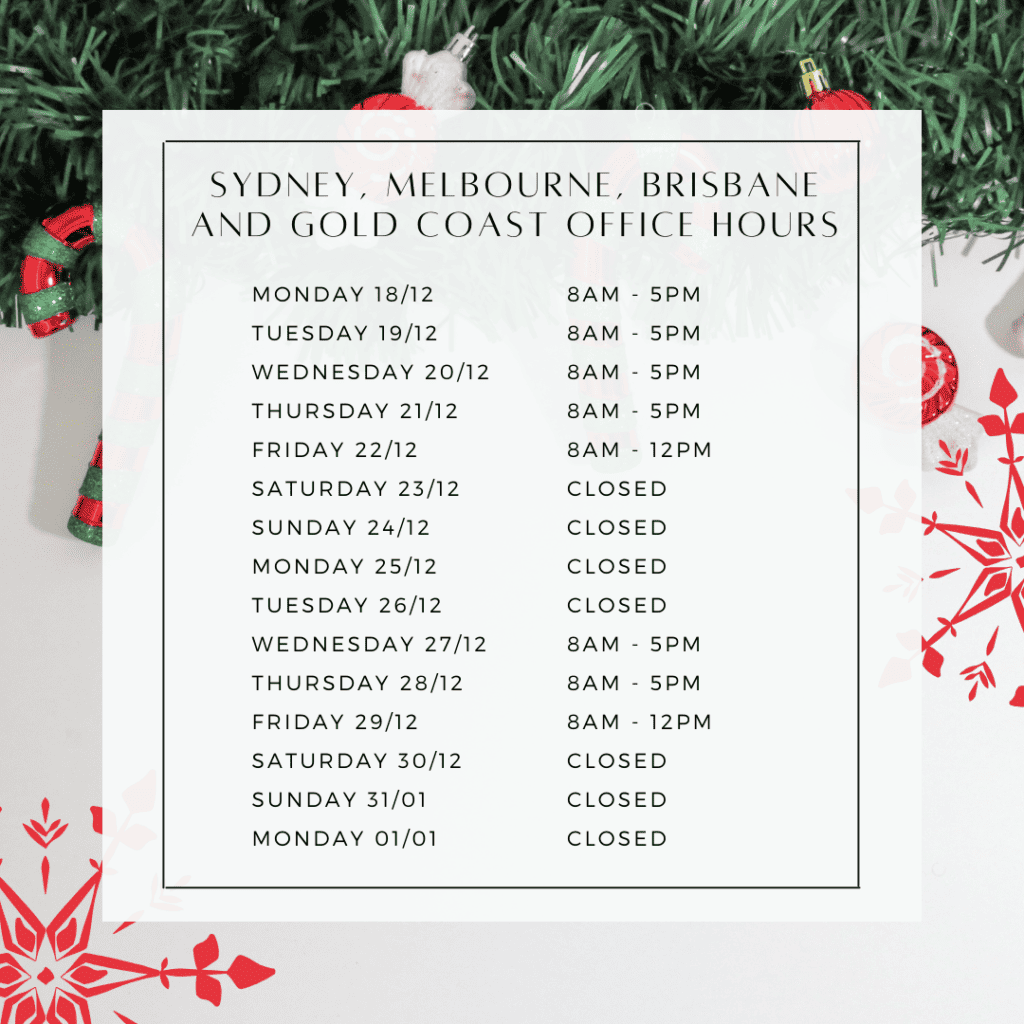

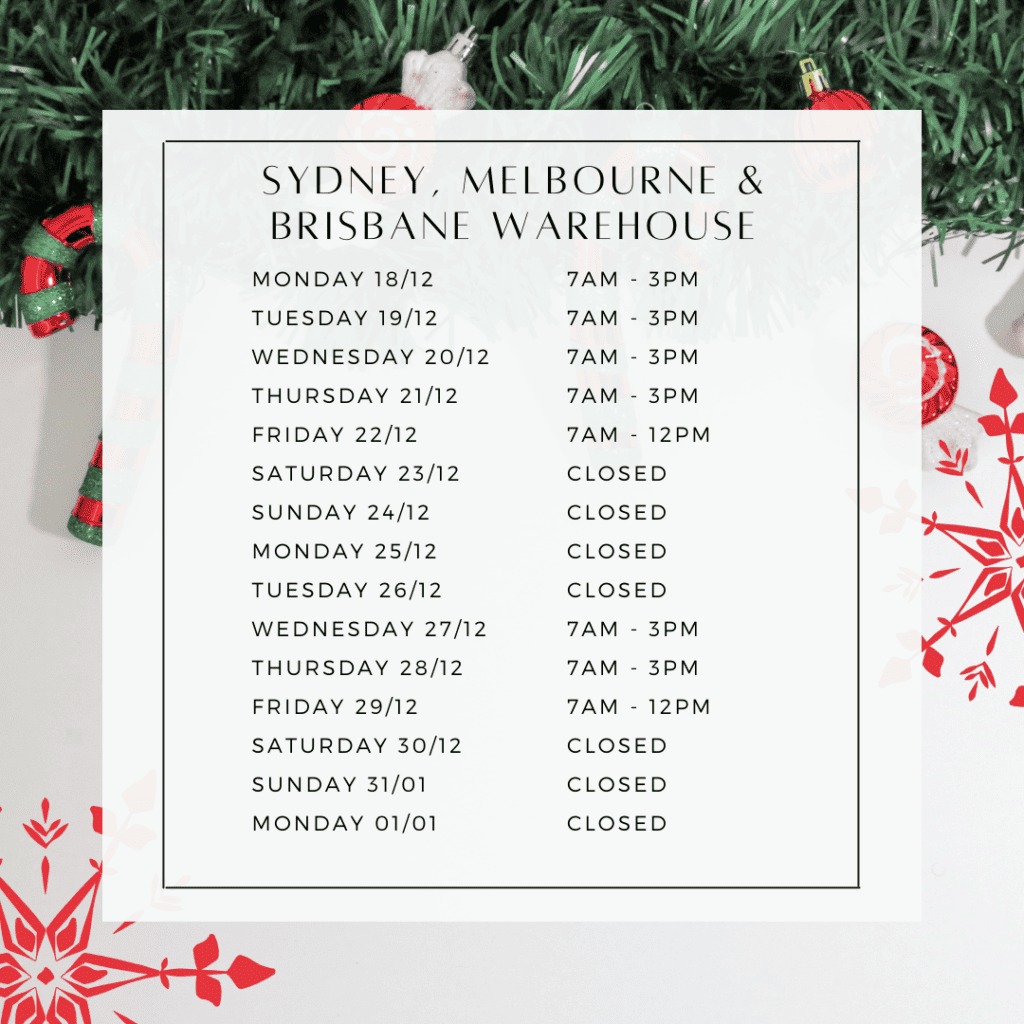

Christmas Office and Warehouse Hours

BMSB Fact Sheet to Download

Stockwell International have put together a fact sheet of everything you need to know about BMSB season which starts September 1st, 2023.

Download our BMSB Fact SheetHERE

If you have any issues downloading your copy, contact [email protected] to have one sent to you!

EDI Fee Increase, Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

EDI FEE INCREASE

Effective 1st November

FCL | $24.00

LCL/Air | $13

GRI

Effective November 15th 2023

China, Hong Kong, Japan, Korea and Taiwan to Australia and New Zealand

Per TEU | $100

Southbound Rate Restoration

PONDUS FEE

Effective 1st October 2023

BAF Charges

Effective November 1st 2023

Asia – North East Asia, South East Asia, West Asia, Europe to Australia

Dry – $180 – $390 USD/TEU

RF – $270 – $580 USD/TEU

Australia to Asia – North East Asia, South East Asia, West Asia

Dry – $70 – $170 USD/TEU

RF – $110 – $250 USD/TEU

Australia to New Zealand

Dry – $50 USD/TEU

RF – $70 USD/TEU

Australia to Europe, Africa

Dry – $140 USD/TEU

RF – $210 USD/TEU

Australia to South Pacific

Dry – $281 USD/TEU

RF – $422 USD/TEU

All Area (Excl. N. & S. America) to New Zealand & South Pacific

Dry – $280 – $600 USD/TEU

RF – $420 – $900 USD/TEU

New Zealand & South Pacific to All Area (Excl. N. & S. America)

Dry – $145 – $310 USD/TEU

RF – $210 – $46 USD/TEU

Transport Wharf Charges

Effective July 1st, 2023

Sydney

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $125.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $130.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Booking Fee $110.00

Weighbridge Fee $50.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $80.00

Infrastructure Fee $85.00

Empty Booking Fee $95.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st November 2023

NSW/QLD/VIC – 26%

WA – 30%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1

The post Stockwell International Urgent News Alert 16 November 2023 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 30 October 2023 appeared first on webfx.

]]>Stockwell International have received an update regarding the DP World Industrial Action:

ACFS Port Logistics (ACFS) would like to provide further updates on the impending Industrial Action across the DP World Terminals.

The CFMMEU has given notice to DP World of further Protected Industrial Action through to the 6th November 2023 which includes the following:

Summary of the Port Stoppages

DP World Sydney:

- A stoppage of work of 24 hours duration commencing 0600AM Monday 30th October and finishing 0600AM Tuesday 31st October

- Stoppages of work of 1 hour duration from 0500-0600AM, 1300-1400PM, and 2100-2200PM each day starting from 0600AM Monday 30th October and finishing 0600AM Monday 6th November

- A ban on the loading and unloading of trucks and trains commencing 0600AM Friday 3rd November and finishing 0600AM Saturday 4th November.

DP World Brisbane:

- Ban on loading / unloading trucks & trains (06:00 3/11 TO 06:00 4/11)

- The two-hour rolling stoppages are impacting Old Yard operations and the receival & delivery of Reefer containers. All general cargo receival and delivery continues through the Automated Stacking Cranes (ASCs) during the rolling two-hour stoppages.

DP World Melbourne:

- Ban on the performance of upgrades and day shifts.

DP World Fremantle:

- Ban on loading / unloading trucks & trains (06:00 3/11 TO 06:00 4/11)

Download a copy of the latest DP World announced list of bans which include “Ban Code”, “Start Date”, and “End Date” HERE

ACFS is working closely with the terminals in each State to minimise the disruptions and delays wherever possible.

Stockwell International will continue to keep you updated with a new information we receive. Please note any additional charges that accrue during this time will not be the responsibility of Stockwell International.

Illegal Logging E-Update – Australian Government Department of Agriculture, Fisheries and Forestry

We have developed new guidance material to help importers and processors of regulated timber products to understand and meet their due diligence requirements under Australia’s illegal logging laws.

A good due diligence system will help you assess the risk of the product containing illegally logged timber and, where appropriate, mitigate the risk.

Separate toolkits are now available on the department’s resources page for importers and processors that outline the five key due diligence steps. These toolkits are optional, but we encourage you to use them as they are designed to assist with your due diligence activities. They align with the illegal logging laws and the way the department conducts compliance audits. Toolkits are the only departmentally endorsed guidance material and you should exercise caution when relying on other guidance material. We welcome your feedback on the toolkits so we can continue to refine and improve these resources into the future.

The toolkits include guidance on conducting a risk assessment, but we have also updated the risk assessment templates available on our website for importers and processors. These are step-by-step guides on how to undertake each risk assessment method allowed under our illegal logging laws – the Timber Legality Framework method, Country or State Specific Guideline method and the Regulated Risk Factor method.

We have also updated our webpage content relating to risk assessment processes for both importers and processors.

Understanding your due diligence requirements – risk mitigation

In the two previous E-updates (e-update 37 and e-update 38) we unpacked the information gathering requirements (step 2) and the risk assessment requirements (step 3) of the five-step due diligence process. In this update, we seek to clarify the requirements for risk mitigation (step 4).

For further clarity on your illegal logging due diligence requirements, please email us at [email protected]. You can also provide anonymous information and report suspected non-compliance via our online form.

Step 4 – Mitigate the risk

If you cannot conclude a low risk rating after undertaking your risk assessment process, you must undertake risk mitigation before importing or processing regulated timber. Risk mitigation requirements are set out in the Illegal Logging Prohibition Regulation 2012 (s 14 for importers and s 23 for processors).

The risk mitigation process must be adequate and proportionate to the identified risk. This process may involve gathering further information about the products and reassessing the risk that the product contains illegally logged timber.

If you do import or process the product and it is later found to contain illegally logged timber, you could face serious penalties.

Where an importer is using a previously completed risk assessment for the exact same regulated timber product, and where no changes have occurred, importers can also use the previous risk mitigation process undertaken for the product and keep a record of having done this. Where any element has changed, the importer must repeat the risk mitigation steps at s 14 of the Regulation.

The same process applies for processors under the respective sections of the Regulation each time they process timber.

You must keep a written record of all risk assessment and risk mitigation steps you take. These records must be retained in accordance with the legislated timeframe of five years from the date of import or processing of the product.

If audited, you must be able to show that the risk assessment and mitigation process (if required) was undertaken prior to importing or processing. For more information on Step 4 of the due diligence process, please visit our website for importers and processors.

Timber legality spotlight – legislative changes in New Zealand

New Zealand is introducing a timber legality assurance system through the Forests (Legal Harvest Assurance) Amendment Act 2023 (the Act). The Act was enacted in May 2023 and will commence within three years.

Under the new system most harvesters, traders, processors, importers and exporters will need to register with the New Zealand Ministry for Primary Industries (MPI) and show how they will reduce the risk of dealing with illegally harvested timber through a due diligence process.

Forest owners and those responsible for forest harvest in New Zealand will need to provide evidence of legal harvest to the log buyers. Documentation will follow the logs or timber through each stage of the supply chain.

New Zealand exporters will be able to apply to the MPI for an exporter statement to help them trade and gain access to markets.

If you are importing from New Zealand once their timber legality assurance system commences, you will be expected to consider the new requirements for New Zealand operators as part of your due diligence process.

To read more about the New Zealand laws, please visit the Ministry of Primary Industries website, or see the Forests (Legal Harvest Assurance) Amendment Act 2023.

Take part in EGILAT’s stocktaking survey

You are invited to take part in a brief online survey related to trade in legal timber in the Asia-Pacific region.

The survey is part of a project under the APEC forum’s Experts Group on Illegal Logging and Associated Trade (EGILAT). It seeks to help EGILAT members better understand regulatory frameworks, requirements, and other measures relevant to the trade in legal timber, along with challenges and opportunities identified by stakeholders like you.

The survey will take around 10-15 minutes to complete and responses will remain confidential. Multiple participants from your organisation may also complete the survey.

The survey is open until 10 November 2023 and can be accessed via this linkor by scanning the QR code below.

Report on Australia’s exposure to illegally logged timber

A report that considers timber trade imports into Australia from countries and regions with a high risk of illegal logging has been released by the Centre for International Environmental Law (CIEL) and the Environmental Investigation Agency (EIA).

The Calculated Risk: Australia’s Exposure to Illegal Logging report aims to inform companies in their efforts to implement, enforce and comply with Australia’s illegal logging laws.

It includes several recommendations for both the Australian Government and Australian companies to reduce illegal timber imports.

While the Australian Government was not involved in developing this report, the department has considered the report’s recommendations and is looking at options for future implementation.

Further information

- See the department’s illegal logging website for information and resources

- Email the department’s environment compliance branch

Call the department during business hours (8.30 am to 5.30 pm) on 1800 657 313 or +61 2 6272 3933 outside Australia

Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

GRI

Effective November 1st 2023

China, Hong Kong, Japan, Korea and Taiwan to Australia and New Zealand

Per TEU | $100

Southbound Rate Restoration

PONDUS FEE

Effective 1st October 2023

BAF Charges

Effective November 1st 2023

Asia – North East Asia, South East Asia, West Asia, Europe to Australia

Dry – $180 – $390 USD/TEU

RF – $270 – $580 USD/TEU

Australia to Asia – North East Asia, South East Asia, West Asia

Dry – $70 – $170 USD/TEU

RF – $110 – $250 USD/TEU

Australia to New Zealand

Dry – $50 USD/TEU

RF – $70 USD/TEU

Australia to Europe, Africa

Dry – $140 USD/TEU

RF – $210 USD/TEU

Australia to South Pacific

Dry – $281 USD/TEU

RF – $422 USD/TEU

All Area (Excl. N. & S. America) to New Zealand & South Pacific

Dry – $280 – $600 USD/TEU

RF – $420 – $900 USD/TEU

New Zealand & South Pacific to All Area (Excl. N. & S. America)

Dry – $145 – $310 USD/TEU

RF – $210 – $46 USD/TEU

Transport Wharf Charges

Effective July 1st, 2023

Sydney

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $125.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Booking Fee $110.00

Weighbridge Fee $50.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $80.00

Infrastructure Fee $85.00

Empty Booking Fee $110.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st October 2023

NSW/QLD/VIC – 26%

WA – 28%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.

These timeframes do not include weekends or public holidays. Please note that notifications made after Midday are not considered ‘Same Day’. The following business day will be considered as day 1

The post Stockwell International Urgent News Alert 30 October 2023 appeared first on webfx.

]]>The post Stockwell International Urgent News Alert 25 October 2023 appeared first on webfx.

]]>Stockwell International have received information regarding war risk insurance in relation to the Israel conflict.

Carriers have imposed a war risk insurance premium on all vessels calling Israel ports.

Effective immediately, shippers have imposed a War Risk Surcharge (WRS) for LCL cargoes will be $5.0 w/m for collect/prepaid shipments for shipments from Israel.

The situation is very fluid and this surcharge is subject to change.

We will continue to keep you updated with any new information that we receive.

Trucking Charges in Germany 2023

Stockwell International would like clients to be aware of charges being applied to trucking in Germany.

German authorities will add a CO2 charge to road toll for trucks. Starting 1st of December 2023, 1 tonne of CO2 emissions for commercial trucks is planned to be charged with EUR $200.00.

We will continue to keep clients updated with new information as we receive it.

For any additional questions, contact [email protected].

DP World Industrial Action Update

Stockwell International have received an update regarding the DP World Industrial Action:

We have received an update that DP World Terminals has advised that the Industrial Action from the CFMMEU will be extended until 6th November.

A summary of the planned stoppages is outlined below.

PLANNED STOPPAGES

30 October 2023 – 06 November 2023

- 2-hour stoppage starting at 0400hr.

- 2-hour stoppage starting at 1200hr.

- 2-hour stoppage starting at 2000hr.

Further updates will be provided as information becomes available.

Stockwell International will continue to keep you updated with a new information we receive. Please note any additional charges that accrue during this time will not be the responsibility of Stockwell International.

Illegal Logging E-Update – Australian Government Department of Agriculture, Fisheries and Forestry

We have developed new guidance material to help importers and processors of regulated timber products to understand and meet their due diligence requirements under Australia’s illegal logging laws.

A good due diligence system will help you assess the risk of the product containing illegally logged timber and, where appropriate, mitigate the risk.

Separate toolkits are now available on the department’s resources page for importers and processors that outline the five key due diligence steps. These toolkits are optional, but we encourage you to use them as they are designed to assist with your due diligence activities. They align with the illegal logging laws and the way the department conducts compliance audits. Toolkits are the only departmentally endorsed guidance material and you should exercise caution when relying on other guidance material. We welcome your feedback on the toolkits so we can continue to refine and improve these resources into the future.

The toolkits include guidance on conducting a risk assessment, but we have also updated the risk assessment templates available on our website for importers and processors. These are step-by-step guides on how to undertake each risk assessment method allowed under our illegal logging laws – the Timber Legality Framework method, Country or State Specific Guideline method and the Regulated Risk Factor method.

We have also updated our webpage content relating to risk assessment processes for both importers and processors.

Understanding your due diligence requirements – risk mitigation

In the two previous E-updates (e-update 37 and e-update 38) we unpacked the information gathering requirements (step 2) and the risk assessment requirements (step 3) of the five-step due diligence process. In this update, we seek to clarify the requirements for risk mitigation (step 4).

For further clarity on your illegal logging due diligence requirements, please email us at [email protected]. You can also provide anonymous information and report suspected non-compliance via our online form.

Step 4 – Mitigate the risk

If you cannot conclude a low risk rating after undertaking your risk assessment process, you must undertake risk mitigation before importing or processing regulated timber. Risk mitigation requirements are set out in the Illegal Logging Prohibition Regulation 2012 (s 14 for importers and s 23 for processors).

The risk mitigation process must be adequate and proportionate to the identified risk. This process may involve gathering further information about the products and reassessing the risk that the product contains illegally logged timber.

If you do import or process the product and it is later found to contain illegally logged timber, you could face serious penalties.

Where an importer is using a previously completed risk assessment for the exact same regulated timber product, and where no changes have occurred, importers can also use the previous risk mitigation process undertaken for the product and keep a record of having done this. Where any element has changed, the importer must repeat the risk mitigation steps at s 14 of the Regulation.

The same process applies for processors under the respective sections of the Regulation each time they process timber.

You must keep a written record of all risk assessment and risk mitigation steps you take. These records must be retained in accordance with the legislated timeframe of five years from the date of import or processing of the product.

If audited, you must be able to show that the risk assessment and mitigation process (if required) was undertaken prior to importing or processing. For more information on Step 4 of the due diligence process, please visit our website for importers and processors.

Timber legality spotlight – legislative changes in New Zealand

New Zealand is introducing a timber legality assurance system through the Forests (Legal Harvest Assurance) Amendment Act 2023 (the Act). The Act was enacted in May 2023 and will commence within three years.

Under the new system most harvesters, traders, processors, importers and exporters will need to register with the New Zealand Ministry for Primary Industries (MPI) and show how they will reduce the risk of dealing with illegally harvested timber through a due diligence process.

Forest owners and those responsible for forest harvest in New Zealand will need to provide evidence of legal harvest to the log buyers. Documentation will follow the logs or timber through each stage of the supply chain.

New Zealand exporters will be able to apply to the MPI for an exporter statement to help them trade and gain access to markets.

If you are importing from New Zealand once their timber legality assurance system commences, you will be expected to consider the new requirements for New Zealand operators as part of your due diligence process.

To read more about the New Zealand laws, please visit the Ministry of Primary Industries website, or see the Forests (Legal Harvest Assurance) Amendment Act 2023.

Take part in EGILAT’s stocktaking survey

You are invited to take part in a brief online survey related to trade in legal timber in the Asia-Pacific region.

The survey is part of a project under the APEC forum’s Experts Group on Illegal Logging and Associated Trade (EGILAT). It seeks to help EGILAT members better understand regulatory frameworks, requirements, and other measures relevant to the trade in legal timber, along with challenges and opportunities identified by stakeholders like you.

The survey will take around 10-15 minutes to complete and responses will remain confidential. Multiple participants from your organisation may also complete the survey.

The survey is open until 10 November 2023 and can be accessed via this linkor by scanning the QR code below.

Report on Australia’s exposure to illegally logged timber

A report that considers timber trade imports into Australia from countries and regions with a high risk of illegal logging has been released by the Centre for International Environmental Law (CIEL) and the Environmental Investigation Agency (EIA).

The Calculated Risk: Australia’s Exposure to Illegal Logging report aims to inform companies in their efforts to implement, enforce and comply with Australia’s illegal logging laws.

It includes several recommendations for both the Australian Government and Australian companies to reduce illegal timber imports.

While the Australian Government was not involved in developing this report, the department has considered the report’s recommendations and is looking at options for future implementation.

Further information

- See the department’s illegal logging website for information and resources

- Email the department’s environment compliance branch

Call the department during business hours (8.30 am to 5.30 pm) on 1800 657 313 or +61 2 6272 3933 outside Australia

Ocean Rates, Southbound Rate Restoration, Transport Wharf Charges, Fuel Levy, Empty Container De-Hire Timeframes

GRI

Effective November 1st 2023

China, Hong Kong, Japan, Korea and Taiwan to Australia and New Zealand

Per TEU | $100

Southbound Rate Restoration

PONDUS FEE

Effective 1st October 2023

BAF Charges

Effective November 1st 2023

Asia – North East Asia, South East Asia, West Asia, Europe to Australia

Dry – $180 – $390 USD/TEU

RF – $270 – $580 USD/TEU

Australia to Asia – North East Asia, South East Asia, West Asia

Dry – $70 – $170 USD/TEU

RF – $110 – $250 USD/TEU

Australia to New Zealand

Dry – $50 USD/TEU

RF – $70 USD/TEU

Australia to Europe, Africa

Dry – $140 USD/TEU

RF – $210 USD/TEU

Australia to South Pacific

Dry – $281 USD/TEU

RF – $422 USD/TEU

All Area (Excl. N. & S. America) to New Zealand & South Pacific

Dry – $280 – $600 USD/TEU

RF – $420 – $900 USD/TEU

New Zealand & South Pacific to All Area (Excl. N. & S. America)

Dry – $145 – $310 USD/TEU

RF – $210 – $46 USD/TEU

Transport Wharf Charges

Effective July 1st, 2023

Sydney

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $125.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Melbourne

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Brisbane

Wharf Booking Fee $75.00

Infrastructure Fee $210.00

Empty Booking Fee $110.00

Direct De-Hire Surcharge $55.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Adelaide

Wharf Booking Fee $85.00

Infrastructure Fee $195.00

Empty Booking Fee $110.00

Weighbridge Fee $50.00

Sideloader Levy $100.00

Terminal Energy Surcharge $7.50

Fremantle

Wharf Booking Fee $80.00

Infrastructure Fee $85.00

Empty Booking Fee $110.00

Weighbridge Fee $20.00

Sideloader Levy $100.00

Booking Admin Fee $30.00

Terminal Interface Fee $75.00

Terminal Energy Surcharge $7.50

Fuel Levy

Effective 1st October 2023

NSW/QLD/VIC – 26%

WA – 28%

SA – 32%

Empty Container De-Hire Timeframes

Please note: Empty container de-hire timeframes differ in each state.

NSW/QLD/WA || Require 72 hours notice to arrange pick-up of empty containers

VIC/SA || Require 48 hours notice to arrange pick-up of empty containers.